What is IRMAA?

IRMAA stands for ‘Income Related Monthly Adjustment Amount’. In other words, it’s a surcharge that certain individuals and couples will be required to pay if they go over certain Modified Adjusted Gross Income thresholds.

If you are enrolled in Medicare Part A, you will have the option to enroll in Medicare Part B. Part B is responsible for covering doctors visits, outpatient therapy, and certain medical equipment. Everyone that enrolls will be required to pay a monthly standard premium. In 2022, that premium is increasing by the largest amount ever, at least in nominal dollars. This premium is designed to pay for about 25% of the total cost of the program, while the other 75% is financed through general revenues.

However, some Medicare beneficiaries will be required to pay a larger share of the total costs if their Modified Adjusted Gross Income exceeds a certain threshold. This is where IRMAA comes in.

The US Centers for Medicare & Medicaid Services reports that roughly 7% of Medicare Part B recipients are affected by IRMAA. While not a lot of people may be impacted by the surcharge, it is one that can become costly if it isn’t planned for properly.

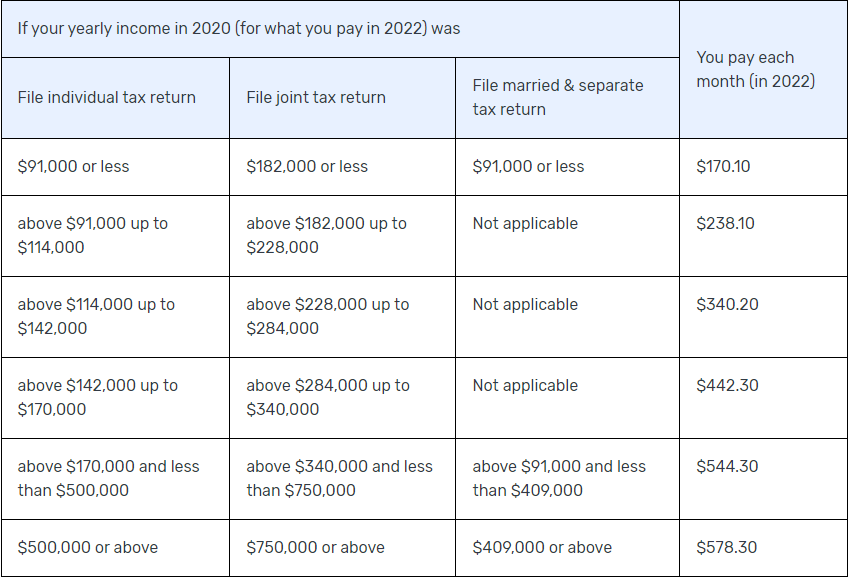

In 2022, the ‘base’ Medicare Part B coverage cost increased by $21.60 ($148.50 -> $170.10). This is the amount that all beneficiaries are required to pay. If you’re MAGI is just one penny above the base threshold, you will have to pay varying amounts based on the bracket you fall under.

Notice the chart says that your yearly income in 2020 impacts what you pay in 2022. That is because Medicare uses a two-year lookback. This can create problems if you have had a substantial life event that resulted in a reduction of income. If one of the life changing events below apply to you, you can appeal IRMAA by filling out the SSA-44 form to prove you’ve had a reduction in income.

Marriage

Divorce/Annulment

Death of Your Spouse

Work Stoppage

Work Reduction

Loss of Income-Producing Property

Loss of Pension Income

Employer Settlement Payment

It’s important to note that IRMAA is not permanent, and if you pay IRMAA in one year, you may not have to pay that every year into the future. There are financial planning strategies to help reduce your chances of paying IRMAA.

Every situation is different. If you have questions about your specific situation, please reach out to us at 330-562-2122 or via our Contact Us page.